Term life for young families & homeownersTerm life coverage is the most cost effective way for young families and homeowners in Tennessee to safeguard their loved ones against the unexpected death of primary wage earner. Term is available in many variations and amounts and can be remarkably affordable. We work with a brokerage that provides excellent service and accurate quotes from dozens of companies.

Let us help you decide what type and amount is best for your family. |

Final expense/burial policies for everyoneMany find themselves without sufficient savings and need a way to insure that their families will not be left with a financial burden when they die. Others have health problems that may prevent them from buying standard life insurance. We have several companies that offer final expense polices with benefits of $5,000-$50,000. The application process is simple and the rates are guaranteed for life. Low monthly payment options are available. Think you can't afford life insurance? Call us -- you may be surprised.

|

Annuities & more for a range of financial needsThere are many types of life-insurance based solutions for a variety of financial needs. Whole life, single-premium whole life, annuities (more info here), and hybrid products may be the answer to your estate planning challenges. We work with experienced financial professionals to provide you with the best advice and personal service.

We'll soon offer long-term care, disability, and Medicare supplement insurance too. |

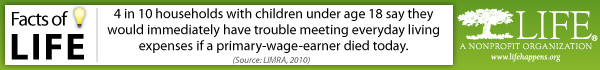

Did you know?

|

Examples of rates & benefits

Here are some eye-opening figures based on real Tennessee life insurance quotes*:

*These are real-world examples but do not guarantee these rates for any specific individual. A variety of rating and eligibility factors are involved.

- A 62-year-old woman (non-tobacco user) can purchase $10,000 in permanent life insurance for as little as $35 per month

- A 40-year-old man in excellent health (non-tobacco user) can purchase 20-year $500,000 term life coverage for only $350 a year.

- A 32-year-old mother in good health (non-tobacco user) can purchase 15-year $500,000 term life coverage for only $19 a month

- A 50-year-old male smoker can purchase 15-year $250,000 term coverage for $95 a month

- A 55-year-old male smoker with COPD can purchase $10,000 in permanent life insurance for $58 a month.

*These are real-world examples but do not guarantee these rates for any specific individual. A variety of rating and eligibility factors are involved.

|

|

|

|