|

Finding affordable Tennessee homeowners and rental property insurance has gotten increasingly difficult in recent years. Rates have been rising and the companies are pickier about what they will insure. We'll do our best to find the right company and policy to cover your house or dwelling. From mansions to manufactured homes, we have quality coverage available for homeowners in the Oak Ridge, Knoxville, Cookeville, Crossville, and Maryville-Alcoa areas.

We also have policies for landlords and renters, as well as vacant structures and builders risk. For some homes we can bundle your home, auto, and umbrella liability for a great package deal. Did you know that flood coverage is not included on any standard home policy? It must be written in a separate policy. We have several companies that will provide flood coverage. Visit our Tennessee flood insurance page. Contact us and we'll help you understand how the age & condition of your home, your credit and claim history, your fire protection class, and the type of home you have affects your rates. Learn about the importance of the home inventory. |

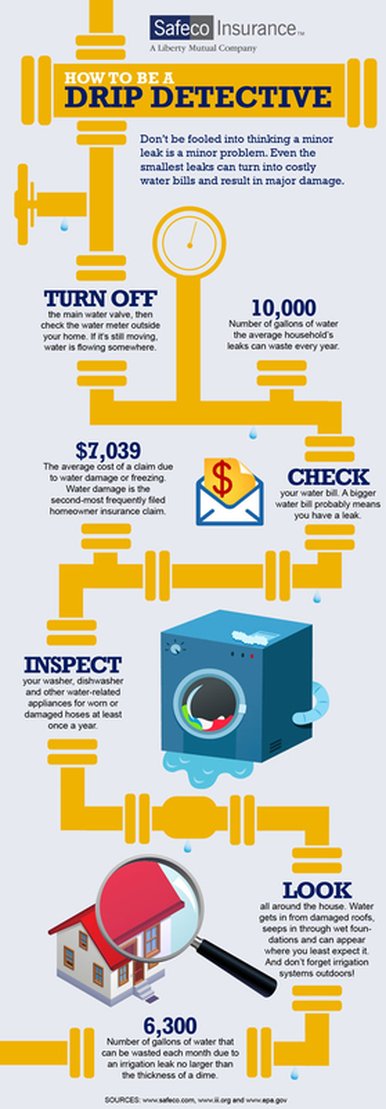

Homeowners tipsIn many parts of the country, consumers have faced substantial increases in their homeowners insurance premiums, particularly in coastal areas subject to hurricanes and windstorms. Other consumers have experienced reduced coverage, moving from all risks coverage for their dwelling to named perils coverage. Still others have received nonrenewal notices due to minor losses, such as water damage claims. The following are some insurance purchasing tips that may help you save premium dollars and reduce losses on your homeowners policy.

Copyright 2008, International Risk Management Institute, Inc. |

|