|

Will a jury always find you liable for a rear-end accident?

"While driving on a parkway in New York in 2005, a wild turkey hit Mary Reilly’s windshield. The impact shattered the windshield, so Reilly put her signal on and slowed down in preparation to pull off onto the left-hand shoulder. Alan Watson was driving behind her and noticed something moving in the median of the roadway. When he returned his gaze to the road, he noticed Reilly’s car was slowing down. He was unable to stop in time and rear-ended her vehicle. Reilly filed Reilly v. Watson, alleging liability on the part of Watson. In most rear-end collisions, the motorist in the rear is found liable, except in cases of mechanical failure, sudden stopping of the vehicle ahead, skidding on wet pavement or another unavoidable, reasonable cause. The jury did not find Watson liable because he provided the court with a non-negligent explanation of the accident." But remember, it usually doesn't go to a jury. You may not be "liable" but you'll probably still be considered "at fault" -- meaning your insurance will pay and your insurance will go up. And you don't have to be cited to be considered "at fault". And, even worse, most parking lot accidents will end up being considered "at fault" for both drivers since there is typically no police report! So, be careful! Why auto insurance costs so much for teen drivers...and why you need more liability for them11/14/2012  There are good reasons that auto insurance for teens is so expensive. Consider these chilling facts from the Centers for Disease Control:

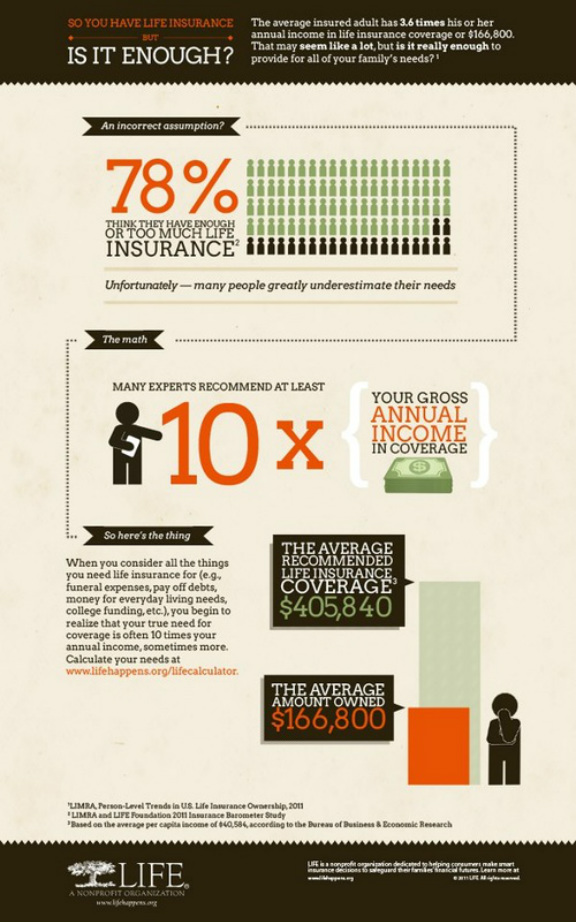

So, it's easy enough to see why auto insurance rates usually double (give or take, depends on many factors) when a teen driver is added -- they are simply far more likely than any other class of drivers to have serious accidents. This is also the reason that parents need increased liability limits if they have teen drivers. Lower limits are just not enough when you consider that teens often have multiple passengers. And parents may be sued for damages caused by their teens (or early-20 somethings) as long as they live at home or even when they live away, provided they are financially-dependent on the parents. This includes college students in most cases. We recommend high limits ($500,000) for anyone with teen drivers plus $1 Million or more in umbrella coverage. A parent's question may be "Can we afford it?". Our question is -- given the dangers -- "Can you afford not to carry higher limits?". We can recommend strategies both for reducing your teen auto insurance costs and for reducing the risk. Reach out to us today; we'd love to help. We'll work hard balance affordability and coverage for your family and assets. Here are some excellent teen driving resources for parents and teen drivers: Teensurance safety & tracking program -- from one our favorite companies, Safeco. Teen-parent driver contract from Travelers -- an excellent idea that sets parameters and expectations. Stop texts/stop wrecks -- texting is a huge risk factor for teen drivers. Defensive Driving Rule #19 -- Avoid Backing Up!

Backing is probably the driving maneuver most likely to lead to an accident. Sensors and cameras may be making it "safer" but new safety rules (higher doors and sides) and style considerations are making visibility worse! And since many backing accidents occur on private property (parking lots) both drivers will be considered at-fault: the police usually do not investigate or make a determination of fault. Your insurance pays for your damage and you get rated for an accident. How can you avoid this? Easy, park farther out and choose a spot you can safely back into or one that you can pull through. Read more. There are a couple of companies I have in mind which have a reputation as being unbeatable in terms of rates and service. The funny thing is, we can usually beat either one, sometimes by a wide margin. So, the conventional wisdom is not always to be trusted in the insurance world. An independent agent can steer you to the best deal.

Hints as to who I'm thinking about:

That's right! Our best auto company for preferred risks has actually dramatically lowered their rates for customers with good credit and excellent driving records. In fact, three of our other auto companies have taken similar decreases. There's never been a better time to have an independent agent look at your coverage. And there's more to this than saving money. Many of our clients use some of their savings to improve their coverage. Let us work with you to find the best cost/coverage mix.

70 Rules of defensive driving #9: Don't run red! (and watch out for those who do)

"In the defensive driving world, we say, "the green light anticipator met the red light procrastinator." The collision of these two is usually a "T-bone" - where the two vehicles meet at a 90 degree angle. It's not a "nice" collision. The typical speed through an intersection is over 50 mph! You'd find this is one of the most commonly fatal collisions - one in which seat belts and normal rear-firing air bags won't help you much." "Be careful around intersections. If you get a yellow light, stop. You can anticipate when the light is about to change, so it is no excuse to say it was too late. If you have the green light, watch for the red-light runner—look left, right, then left AGAIN to make sure the intersection is going to be safe before you enter it, even on one-way streets (because somebody might be going the wrong way AND running red lights). Red light runners are often speeding as well, so make sure you look down the road far enough to see them coming." I've been a victim of just such a red-light t-bone. It was no fun. Another foot or two forward and I probably wouldn't be here. http://www.roadtripamerica.com/forum/content.php?16-Defensive-Driving-Rule-9-Don-t-Run-Red |

AuthorOwner/agent Brad Isbell is a strange person -- he actually likes to talk and blog about insurance, safety, and saving money. Archives

November 2013

|

RSS Feed

RSS Feed